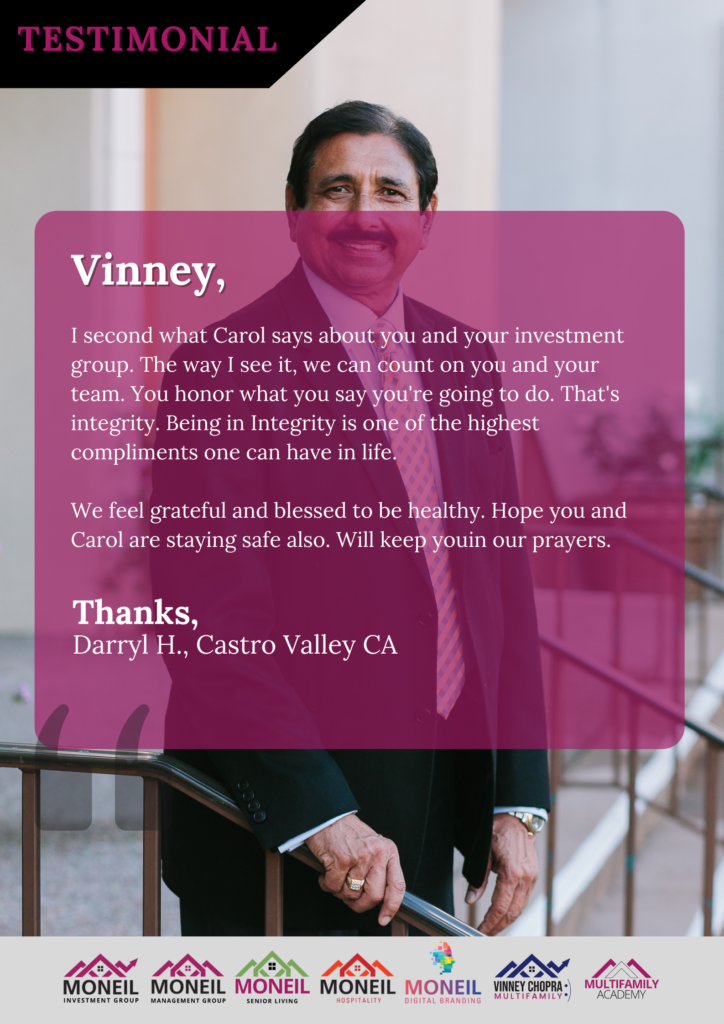

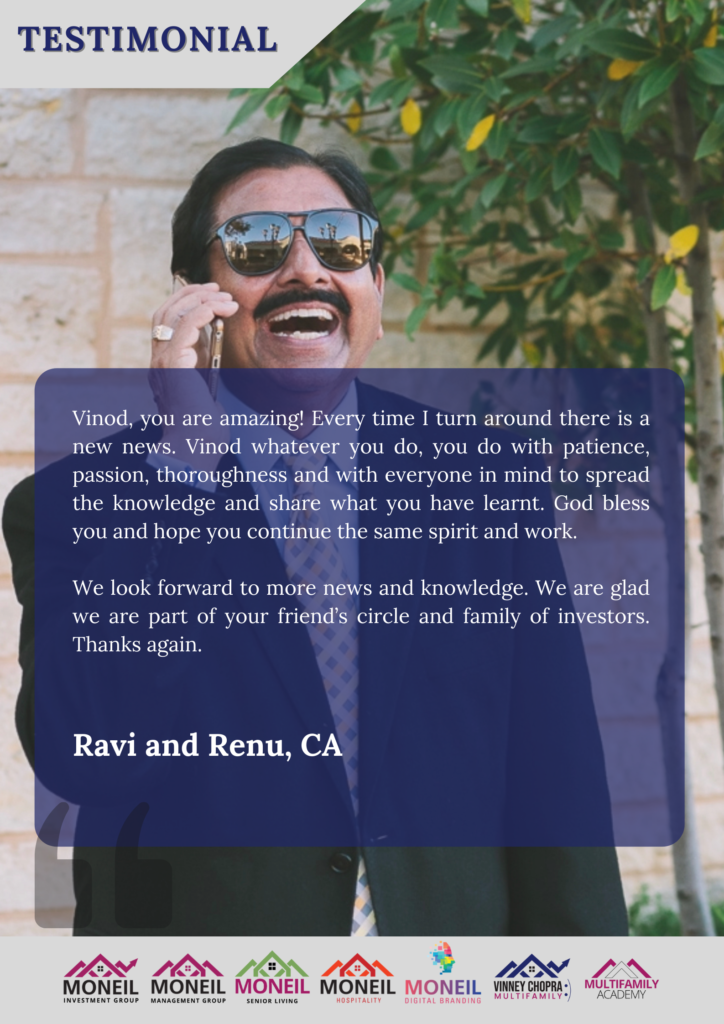

Experience Vinney’s Commitment Through Our Customers’ Voices

Thank you for your interest in investing and partnering with us in an upcoming opportunity. To obtain information on future investment opportunities and begin the conversation about possibly partnering with us, please complete the following information and we will be in touch with you.

Vinney Chopra is a Multifamily Investor, Syndicator, Educator, Motivator, Podcaster and Author.

Copyright © 2024. All rights reserved. Designed by iTechEra Solutions